To Qualify For The Home Owner Grant

Detailed Eligibility Criteria Registered Owner and Relationships: Eligibility for Deceased Owner’s Property: If the registered owner of the property has passed away, the surviving spouse or a relative who inherits the property can still claim the Home Owner Grant, provided they meet the other eligibility requirements. This can include proving that they are the rightful…

Read articleHome Buyer Rescission Period

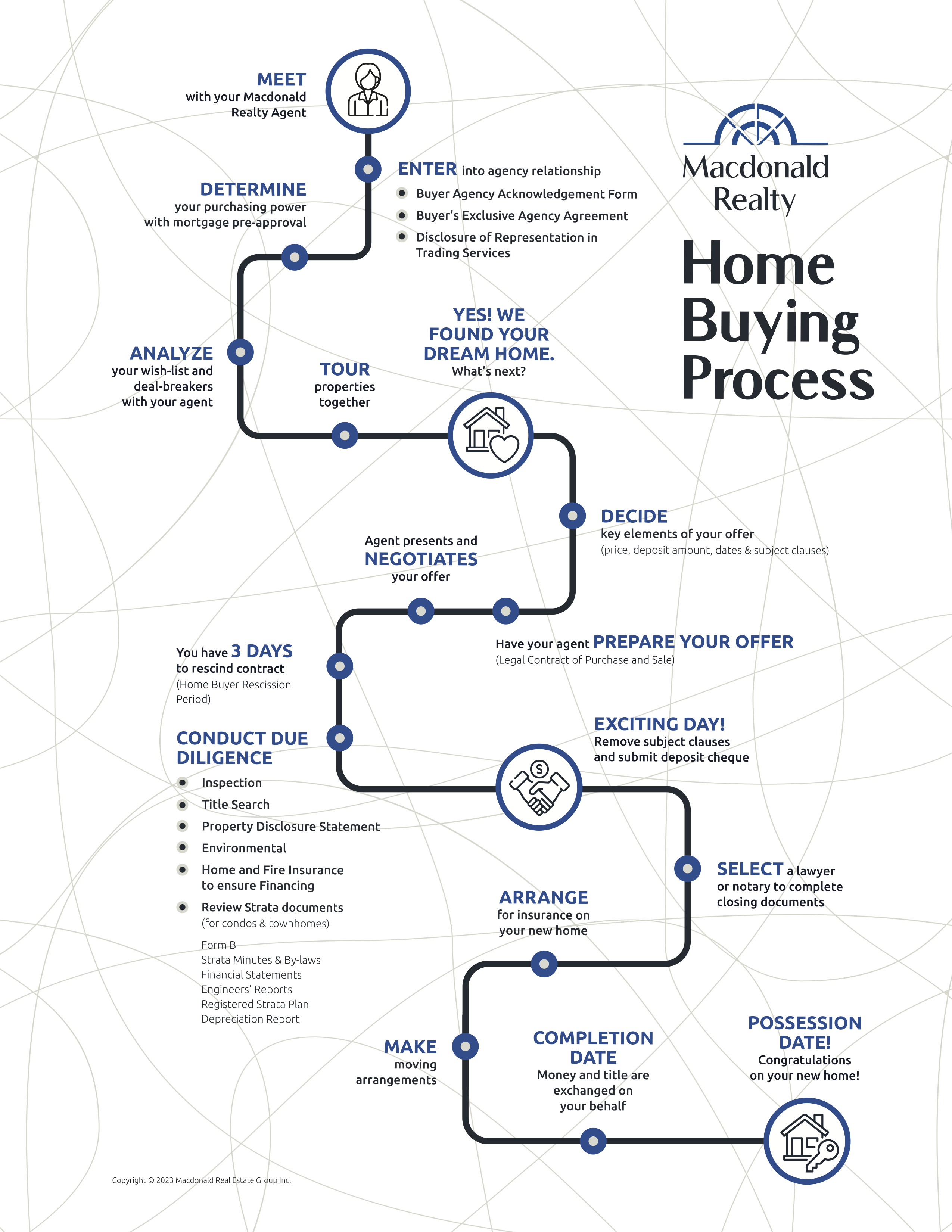

Home Buyer Rescission Period in British Columbia Duration: The rescission period is 3 business days, not calendar days. This means it excludes weekends and statutory holidays. The period begins the day after the buyer signs the purchase agreement and typically ends at 11:59 PM on the third business day. Cost: If a buyer chooses to…

Read articleContract of Purchase and Sale

Contract of Purchase and Sale Guide When you are prepared to make an offer on a property, you will use a Contract of Purchase and Sale. Your real estate agent will assist you in completing this document. Here is a breakdown of the key elements: Identification: You will need to provide your Driver’s License as…

Read article